Discover the timeless wisdom of one of Wall Street’s most influential traders with “My Secrets of Day Trading in Stocks” or “The Day Trader’s Bible” by Richard D. Wyckoff. This classic work, initially published in the early 20th century, has stood the test of time as an essential guide for anyone serious about mastering the complex world of day trading.

Richard D. Wyckoff, a pioneering figure in the field of technical analysis, distills his vast experience and innovative strategies into a comprehensive manual that has empowered countless traders. Whether you’re a novice or a seasoned professional, Wyckoff’s insights provide a clear path to understanding and predicting market behavior with unparalleled accuracy.

In this indispensable volume, you will uncover:

Market Cycles: Learn to identify and navigate the phases of the market, from accumulation to distribution, and capitalize on these trends.

Technical Analysis: Gain mastery over the art of reading price charts and volume patterns, equipping you with the knowledge to make informed trading decisions.

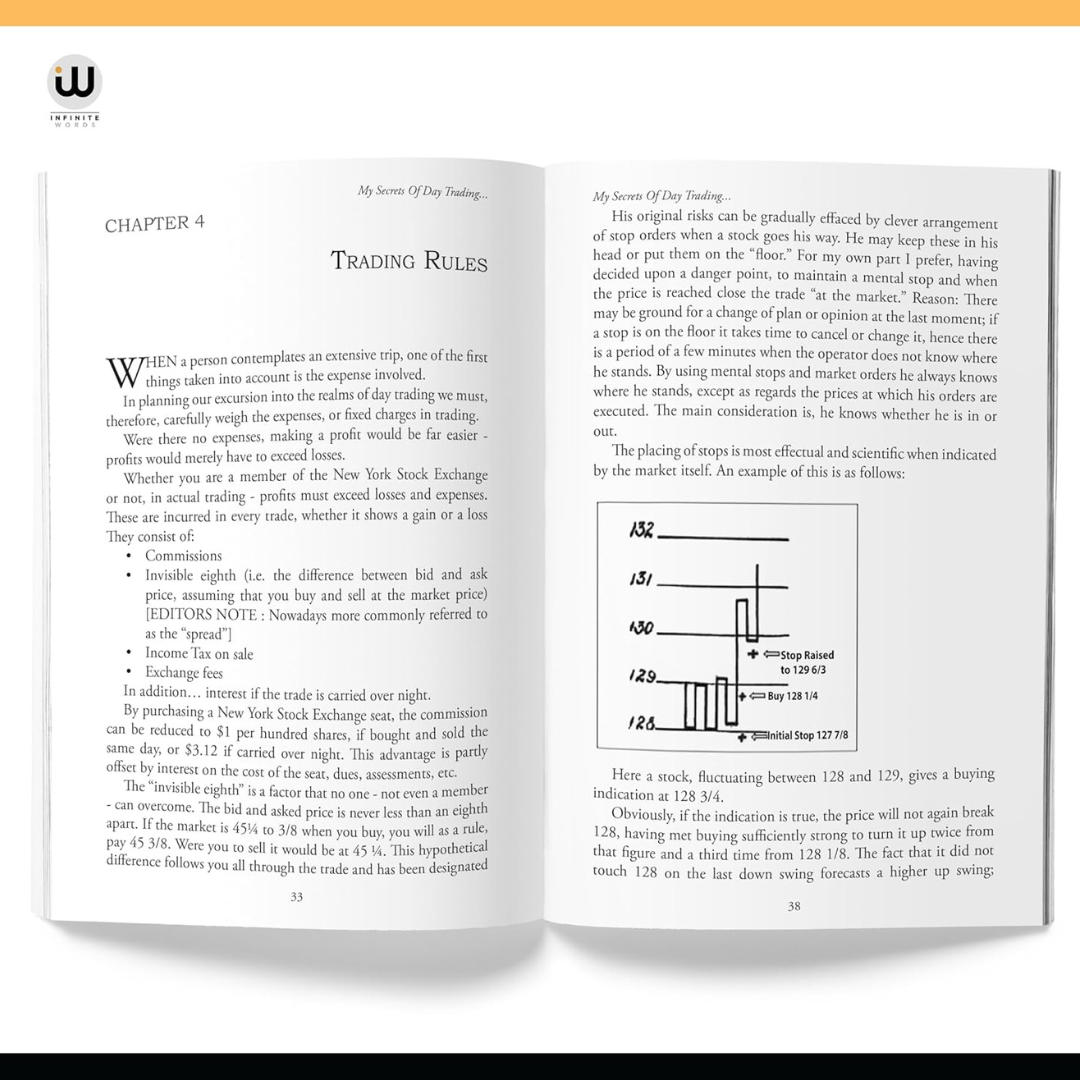

Trading Strategies: Implement Wyckoff’s time-tested techniques for intraday and swing trading to enhance your trading performance.

Psychological Mastery: Develop the mental fortitude and discipline necessary for successful trading, managing risk, and controlling emotions.

Richly illustrated with practical examples and case studies, this is more than just a book; it is a foundational resource that continues to educate and inspire traders around the globe. Wyckoff’s teachings remain profoundly relevant in today’s dynamic markets, providing a blueprint for financial success.

Unveil the psychological underpinnings of market behavior with Psychology of the Stock Market by G. C. Selden. First published in 1912, this timeless classic explores how human emotions and impulses drive market movements, offering insights that remain as relevant today as they were over a century ago.

In this essential guide, you will discover:

Human Emotions in Trading: Understand how fear, greed, and hope influence market decisions and investor behaviors.

Behavioral Patterns: Learn to recognize recurring psychological patterns and their impact on trading trends.

Market Psychology Framework: Gain a deeper understanding of the psychological principles that underpin the stock market.

Practical Applications: Practical advice on how to leverage psychological insights for more effective trading strategies.

G. C. Selden’s clear, thoughtful analysis makes complex psychological concepts accessible to traders of all levels. By delving into the emotional dynamics of the stock market, this book provides invaluable tools to make more rational and informed trading decisions. Enhance your market acumen and achieve greater success by grasping the essential psychological factors at play.

Reviews

There are no reviews yet.