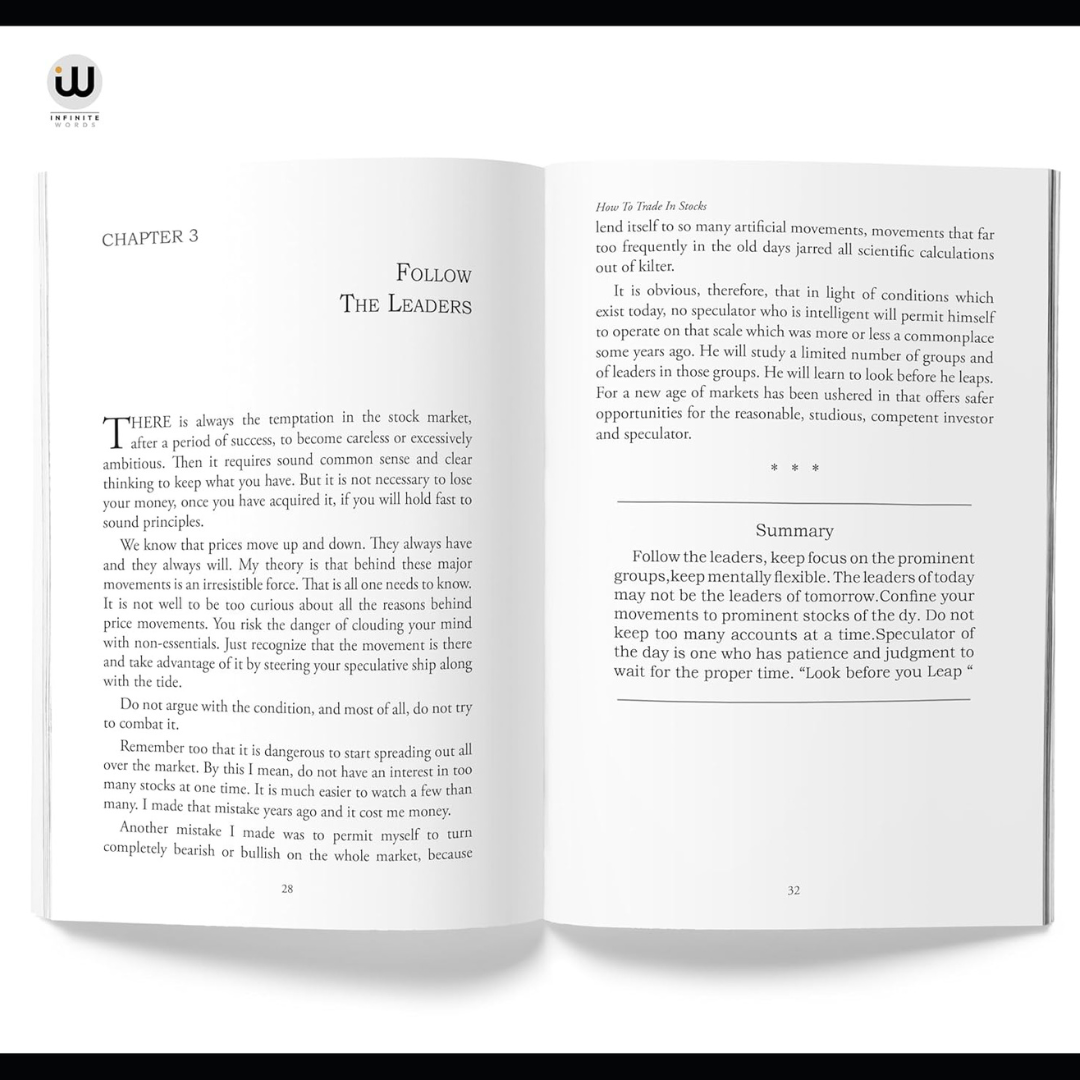

In his groundbreaking book, “How to Trade in Stocks,” Jesse L. Livermore — one of the greatest stock market traders of all time — unveils the strategies and tactics that made him a legend in Wall Street. Drawing from his own experiences and insights, Livermore provides readers with a timeless guide to understanding market psychology, identifying profitable trades, and mastering the art of speculation.

Filled with real-life anecdotes and invaluable lessons, this seminal work covers essential topics such as:

The importance of timing and trend recognition

Techniques for managing risk and capital preservation

Detailed explanations of market mechanics and trading frameworks

Livermore’s wisdom remains as pertinent today as it was in the early 20th century, offering modern traders and investors practical advice to navigate the complexities of the stock market with confidence and intelligence. Whether you’re a novice looking to get started or a seasoned trader aiming to refine your skills, “How to Trade in Stocks” is an indispensable resource that promises to enhance your trading acumen and pave the way for enduring success.

Discover the time-tested principles that have influenced generations of traders and learn to approach the markets with the disciplined mindset of a true Wall Street icon.

Unveil the psychological underpinnings of market behavior with Psychology of the Stock Market by G. C. Selden. First published in 1912, this timeless classic explores how human emotions and impulses drive market movements, offering insights that remain as relevant today as they were over a century ago.

In this essential guide, you will discover:

Human Emotions in Trading: Understand how fear, greed, and hope influence market decisions and investor behaviors.

Behavioral Patterns: Learn to recognize recurring psychological patterns and their impact on trading trends.

Market Psychology Framework: Gain a deeper understanding of the psychological principles that underpin the stock market.

Practical Applications: Practical advice on how to leverage psychological insights for more effective trading strategies.

G. C. Selden’s clear, thoughtful analysis makes complex psychological concepts accessible to traders of all levels. By delving into the emotional dynamics of the stock market, this book provides invaluable tools to make more rational and informed trading decisions. Enhance your market acumen and achieve greater success by grasping the essential psychological factors at play.

Reviews

There are no reviews yet.